In this week’s roundup, we talk about the draft Digital Trade Facilitation Bill 2026, changes to India’s CPI, why SEBI wants tighter ETF ties, India’s carbon credit market and why China’s manufacturing playbook is irreplaceable.

Also, in this week’s Markets edition, we break down the Gaudium IVF and Women Health IPO. You can read it here.

With that out of the way, let’s look back at what we wrote this week.

Can India really kill red tape?

India has spent years reforming business laws, from insolvency rules to GST. Yet some businesses still run into problems that are much more old-fashioned: paperwork. One such industry is cross-border trade. You see, trade here often moves more slowly on documents than on ships.

And the Draft Digital Trade Facilitation Bill 2026 aims to change that by giving electronic trade documents the same legal status as paper ones, and recognizing trusted foreign digital signatures. If implemented well, it can reduce clearance times and ease working capital pressure. But digitizing these documents and approvals still has its own hurdles.

So, will this bill finally remove India’s paper bias or just put digital systems on top of old habits?

Find out in us Monday story.

India’s new CPI explained

India’s inflation numbers are shaped by what households buy – and how much importance each item carries. But those weights are frozen in time, based on spending patterns since 2012. Since then, consumption has gradually shifted away from food and toward housing, transportation, health care, education and services.

The revamped CPI updates the base year, expands the basket and adjusts weights to reflect how Indians actually spend today. It also brings India’s inflation measurement closer to global standards, subtly changing what drives headline inflation and how price pressures appear month to month. In our Tuesday storywe explain how India’s new CPI is changing the way inflation is measured and felt.

SEBI wants tighter ETF ties

ETFs are suddenly everywhere, especially with all the chatter surrounding gold and silver price volatility. They seem simple on the surface. They follow an asset, trade like a stock, done.

But behind the scenes there is a delicate mechanism that keeps their prices in line with the real value of what they own. And that mechanism depends a lot on how reference prices are set.

Now SEBI thinks that this system needs to be reconsidered.

In a recent consultation paper, the market regulator proposed changes to how ETF basis prices are calculated and how extreme volatility is handled. It sounds technical. But it can significantly change how ETFs trade, especially on wild market days.

So what exactly is SEBI trying to fix, and can these tweaks help?

Find out in Wednesday’s newsletter here.

Can India get carbon credits right?

Historically, India has contributed only a small fraction of global emissions. But pollution has now become a very real economic cost in the country.

The Union government has therefore introduced a budget of ₹ 20,000 crore for carbon credit capture programs and to implement a formal carbon credit trading scheme.

In theory, carbon markets reward those who reduce emissions and penalize those who do not. In practice, however, a weak verification system can turn the same credits into mere accounting tricks rather than measuring actual carbon captures.

So can we design a carbon market that actually reduces pollution, not just shifts it around?

You can read about it here.

Why can’t the world replace China?

Over the past few decades, China has been quietly building something far more powerful than cheap factories. Suppliers, component manufacturers, logistics providers, engineers and exporters work side by side, enabling companies to move from design to mass production at a speed and scale that few countries can match.

This dense industrial clustering lowers costs, reduces uncertainty and creates efficiencies that work together over time. Even as companies talk about “China-plus-one” strategies, shifting production isn’t just about finding cheaper labor elsewhere. in yesterday’s storywe explain what makes China’s rand so difficult to replace.

Finshots Weekly Quiz v2.0 🧠

Hey people! As you probably already know, the Finshots Weekly Quiz has a new avatar. If you’ve missed it over the past few months, don’t worry. Click here to check the rules and set a reminder to participate consistently starting next month!

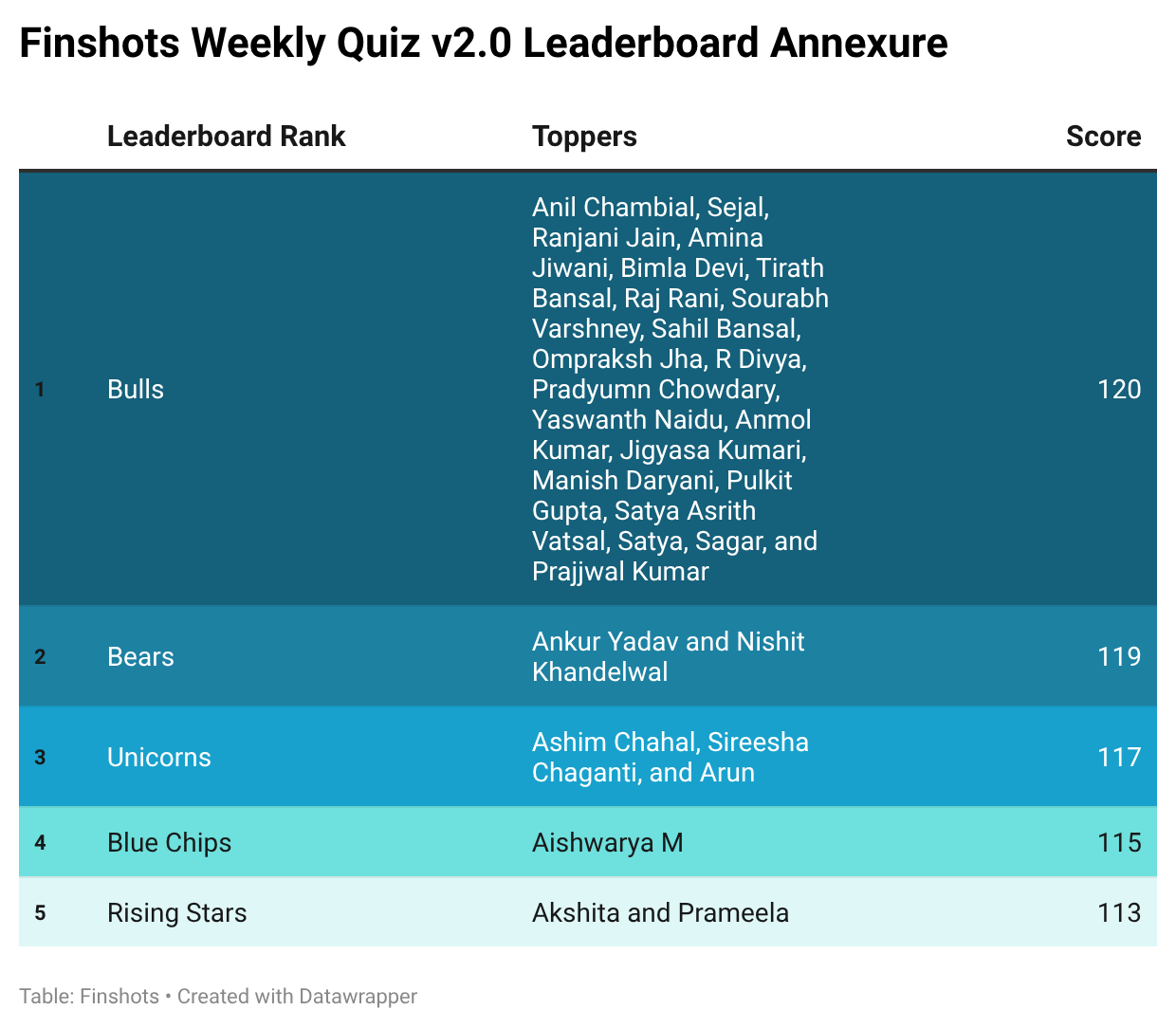

Let’s then move on to the top scorers from our previous weekly quiz. There were quite a few of you who participated, and many of you ended up with the same scores. So we call you Bulls, Bears, Unicorns, Blue Chips and Rising Stars. Here’s how the standings currently look:

If your name appears on the leaderboard, then congratulations! If not, don’t lose hope. If you tried last week’s quiz, keep at it and answer all the weekly quizzes this month. You never know when the turntables! Click on this link to take this week’s quiz, which is open until 12pm, Friday, February 27, 2026. The more answers you get right, the better your chances of appearing on the Finshots Weekly Quiz leaderboard. We will publish it every Saturday in the Weekly Wrapup. And the winner will be announced in the first week of March.

Did you like this week’s wrap up?

Don’t forget to share it with your friends, family or even strangers WhatsApp, LinkedInand x. And subscribe to Finshotsif you haven’t already. Please!

How strong is your financial plan?

You’ve probably ticked off mutual funds, savings, and maybe even some added pressure. But if Life Insurance is not part of it, your financial pyramid is not as safe as you think.

Life insurance is the crucial foundation that holds all your wealth together. This ensures that your family remains financially protected when something unpredictable happens.

If you are unsure where to start, Ditto’s IRDAI certified insurance advisors can help. Book a FREE 30 minute consultation and get honest, unbiased advice. No spam, no pressure.

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/1771689388_The-Gaudium-IVF-IPO-Indias-new-CPI-and-more….jpg)

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/McDonalds-milkshake-healthier-polar-bears-and-more.jpg)

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/Gold-is-volatile-Question-is-not.jpg)