In this week’s roundup, we discuss the Union Budget 2026, India’s government finances, gold price volatility, the Canada-India uranium deal and the Indian cricket ball manufacturing industry.

And in this week’s Markets edition, we explain whether the STT hike in the latest Budget could help curb the frenzy over derivatives. You can read it here.

With that out of the way, let’s look back at what we wrote this week.

The budget 2026 explained

If you’ve been waiting for the Budget, as we do every year, to see what it has in store for you, you’ve probably realized by now that there isn’t much for people like you and me. But expecting every budget to be a “people’s budget” is also a bit unfair. The government must also keep its finances in check and plan for the long term.

And that means focusing on things that actually move the growth needle – like boosting manufacturing and exporting goods and services. This is what ultimately attracts investors to a country. And that is exactly what this budget is trying to do. It relies on manufacturing and the broader economy to allow India, even amid global uncertainty, to grow faster than other emerging markets.

You can watch the main highlights in our Monday newsletter here.

The paradox of India’s sound finances

If you read our story on the Economic Survey, you may have noticed that India’s fiscal story looks better than it has in years. The Center cuts deficits and spends heavily on infrastructure. This has not only impressed global rating agencies, but also the bond markets.

But here’s the twist.

When you shift your gaze from the Center to the states, the picture is not so comforting. Many states spend far more than they earn, often on incentives that don’t clearly translate into growth. The big question, however, is whether it can last.

We unpack it Tuesday’s newsletter here.

Gold is volatile. Question is not.

Gold was on a wild ride. Large daily swings. Fresh highlights. And price movements that don’t quite make sense if you look at the headlines alone.

Trade deals were signed, tariffs were cut, stock markets even cheered. Normally this is when gold cools. But this time it didn’t.

Instead, gold and silver continued to move as if uncertainty had increased. And this is what confuses everyone. It tells you that something deeper is at play here. Something that is not clear from the news cycle.

This is exactly what our Wednesday newsletter delves into. We tell you why this rally feels so different and why it’s making investors uneasy. You can read it here.

The Canada-India uranium deal explained

Nuclear power has a habit of resurfacing whenever countries start to worry about long-term energy needs. And this time, it’s a nearly $3-billion uranium deal with Canada that’s putting it back into focus. On the face of it, this looks like a routine supply agreement.

But here’s the thing. India’s uranium requirement is already well beyond what domestic mines can reliably supply. So why do we need this agreement then?

Find out in Thursday’s newsletter here.

A vegan cricket ball that lasts 50 overs?

A cricket ball looks simple. But making one is slow and requires precision. Most of the steps involved are still done by hand, often in small homes across India.

It’s a craft that hasn’t changed much in centuries, and for good reason. Leather balls behave a certain way, and the game has grown around that certainty.

That’s why a recent development feels disruptive.

Sanspareils Greenlands (SG), a major Indian manufacturer, has built a professional cricket ball that uses no leather at all. And it seems to behave close to traditional leather balls. This means it could eventually start to replace the regular cricket ball.

On the face of it, exchanging learning seems to solve real problems. But what does this mean for the future of the industry?

We explored this in Friday’s story. You can read it here.

Finshots Weekly Quiz v2.0 🧠

Hey people! A few months ago we put the Finshots Weekly Quiz on hiatus because we prepared something new. And last month we finally unveiled the Finshots Weekly Quiz v2.0. If you missed out, don’t worry. Click here to check the rules and start taking the quiz today for a chance to make it to this month’s leaderboard, and maybe even win some merchandise!

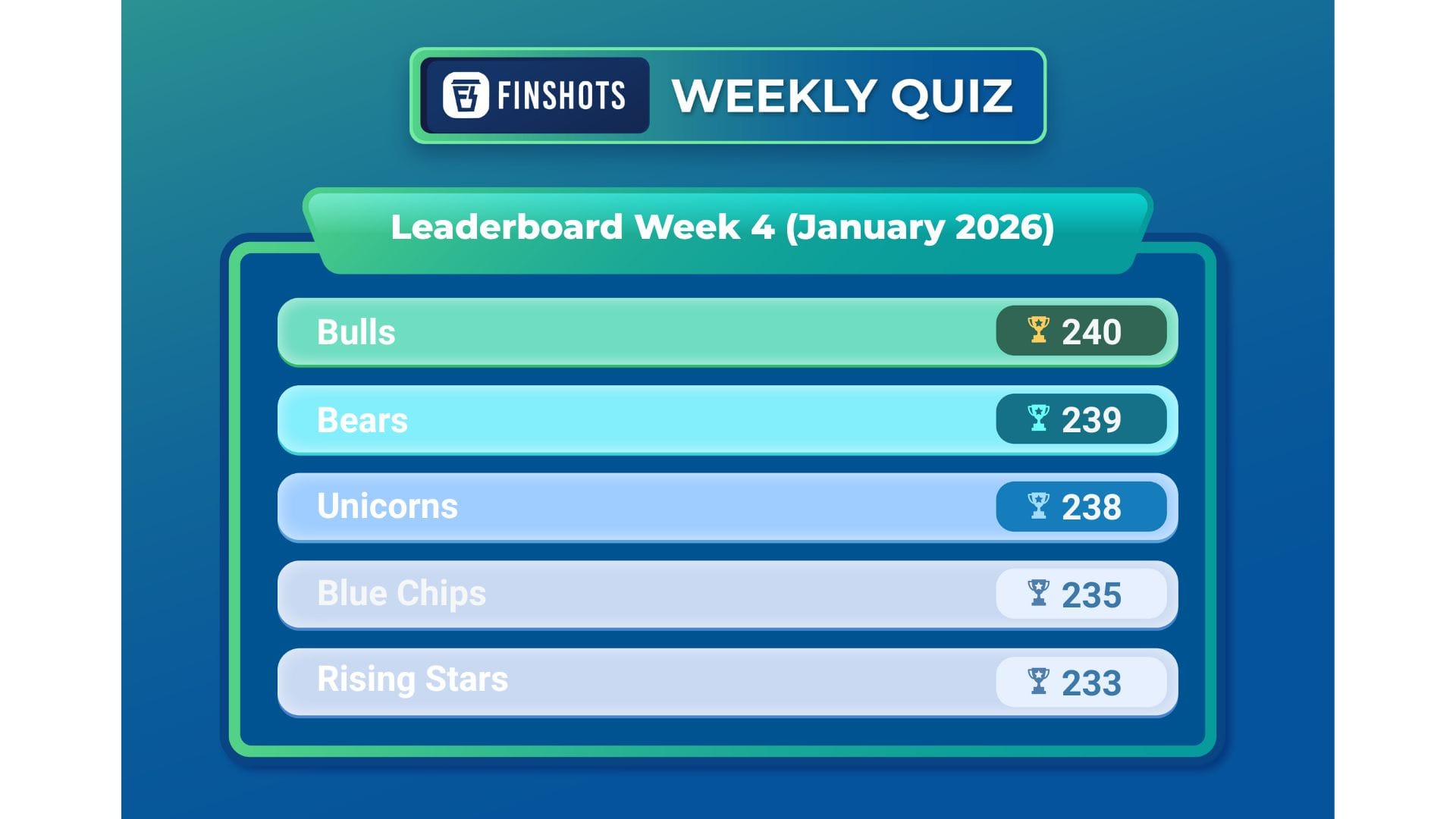

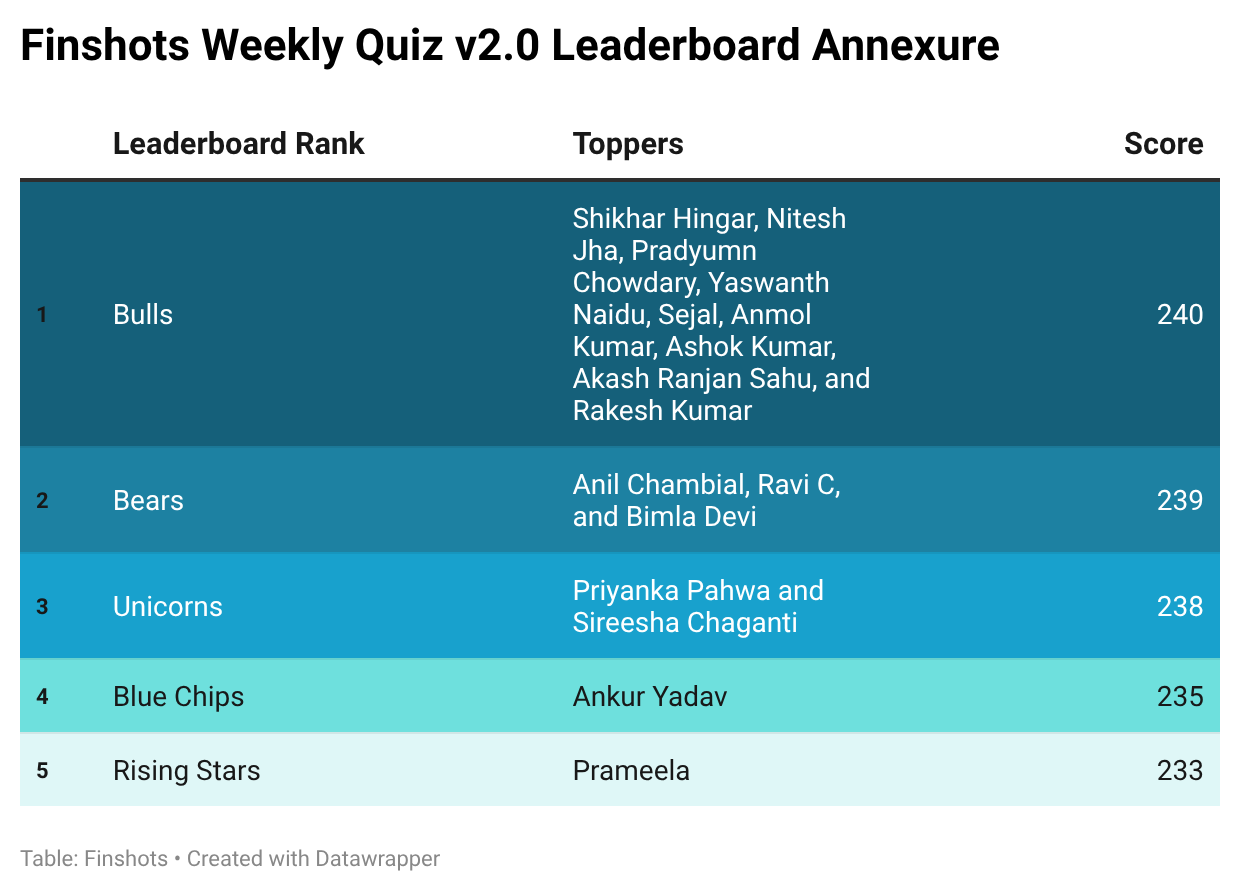

But for now, it’s time to announce the top scorers from our previous weekly quiz. There were quite a few of you who participated, and many of you ended up with the same scores. So we call you Bulls, Bears, Unicorns, Blue Chips and Rising Stars. Here’s how the standings currently look:

As you can see, we have nine top scorers fighting for the merchandise. But unfortunately, there is only one merchandise box to win each month.

So to break the tie, we will send a tie-breaking question by email to all the “Bulls”. Watch your inbox! The one who gets it the fastest wins the exclusive Finshots merchandise for January 2026, and we’ll announce the winner’s name next week.

And to the rest of you whose names made the leaderboard, congratulations! You may not have won the merchandise this time, but you’ve consistently shown up and earned a spot on Finshots’ weekly leaderboard. That’s pretty cool.

So don’t lose hope. Click the reset button this month and continue answering all the weekly quizzes. Who knows? You might just be the winner this time.

Click on this link to take this week’s quiz, which is open until 12pm, Friday, February 14, 2026. The more answers you get right, the better your chances of appearing on the Finshots Weekly Quiz leaderboard. We will publish it every Saturday in the Weekly Wrapup. And the winner will be announced in the first week of March.

Do you like this summary?

Don’t forget to share it with your friends, family or even strangers WhatsApp, LinkedInand x. And subscribe to Finshotsif you haven’t already. Please!

Did you know? Almost half of Indians are unaware of term insurance and its benefits.

Are you among them?

If so, don’t wait until it’s too late.

Term insurance is one of the most affordable and smartest steps you can take for your family’s financial health. This ensures that they do not face a financial burden if something happens to you.

Ditto’s IRDAI certified advisors can guide you to the right plan. Book a FREE 30 minute consultation and find what coverage suits your needs.

We promise: No spam, just honest advice!

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/1771342400_STT-hike-the-Union-Budget-and-more….jpg)

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/STT-hike-Fourth-times-a-charm.jpg)