In this week’s roundup, we discuss the Fractal Analytics IPO, the AI energy crisis no one is talking about, Pax Silica, JLR’s factory in Tamil Nadu, and 100-year bonds.

And in this week’s Markets edition, we talk about something strange in SBI’s latest Q3 results. You can read it here.

With that out of the way, let’s look back at what we wrote this week.

The Fractal Analytics IPO

India’s technical success followed a familiar script. Companies have built global businesses by doing exactly what customers asked for – writing code, managing systems and delivering projects efficiently, but rarely owning the full product or the outcome. But it also meant that Indian tech firms remained behind the scenes even as global companies captured the real value.

Fractal Analytics tries to break that mold. Instead of just performing tasks, it is embedded in how businesses make decisions, using data analytics and AI to influence pricing, marketing, supply chains and risk management. Its business is built on long-term relationships with major global clients, where spending deepens over time rather than reset each year – a model that helped it grow steadily and become profitable in FY25.

So what makes the first AI company listing in India different from other tech companies? Find out in our Monday story here.

The AI crisis no one is talking about

When we talk about AI, the focus is usually on chips and algorithms. But the real bottleneck isn’t GPUs.

You see, modern AI data centers now consume power on the scale of small cities, and grids that are decades old were never designed for such demand appearing so quickly in one place.

Instead of waiting years for transmission upgrades, companies are turning to methane turbines, retired jet engines, and even exploring nuclear reactors just to keep servers running.

So, as AI scales, the real limitation is no longer computing power, but the grid itself?

Read the full breakdown in our Tuesday story.

An explainer on Pax Silica

China could not dominate rare earths overnight. For decades, it cheaply refined, ruthlessly scaled back, undercut competitors and ultimately secured control of global rare earth mineral supply chains. Today, it processes most of the world’s critical minerals that power everything from EVs to AI chips.

Now the US wants to respond to something with shouting Pax Silica – an alliance of “friendly” nations coordinating supply chains, chips, minerals and energy to reduce dependence on China. India was also invited to join.

But breaking China’s grip will not be easy. Mining is dirty, and refining is even harder.

So is Pax Silica a true counterweight or just a belated response to a dominance decades in the making? We break it down in us Wednesday story.

Why is JLR now building in India?

For years, buying a foreign-made car in India meant buying two cars – one for yourself and one for the government. With import duties often exceeding 100%, global automakers had little choice but to set up factories in India if they wanted to sell at scale. That protectionism has helped India build a strong auto manufacturing base, turning states like Tamil Nadu into production hubs rather than just markets for imported vehicles.

This is why Tata Motors’ decision to invest ₹9,000 crore in a new Jaguar Land Rover manufacturing facility in Tamil Nadu feels counter-intuitive at first. After all, India signs trade agreements that promise lower tariffs and easier imports. The move comes at a time when India is negotiating trade deals that could make imports cheaper and easier. If obstacles are coming down, why double down on domestic manufacturing – especially for a global luxury brand that already has factories elsewhere?

In us Thursday story, we break down why this bet makes sense.

Would you put your money in a 100-year bond?

In 1997, Motorola borrowed money that it would not pay back for a century. Today, Alphabet did the same by issuing a 100-year bond that was oversubscribed nearly ten times.

At first glance, this sounds absurd. Why borrow money you will never see back? But these bonds aren’t really about waiting 100 years. For companies, it’s about securing capital for decades. For investors, it’s about diversifying income streams and rate bets.

But would you lock up your capital for such a period? Read yesterday’s story to find out more.

Finshots Weekly Quiz v2.0 🧠

Hey people! As you probably already know, the Finshots Weekly Quiz has a new avatar. If you’ve missed it over the past few months, don’t worry. Click here to check the rules and set a reminder to participate consistently starting next month!

But for now, it’s time to announce the winners. First up, the very first winner of Finshots Weekly Quiz v2.0 for January 2026. Drumroll, please… 🥁 Akash Ranjan Sahu! Congratulations

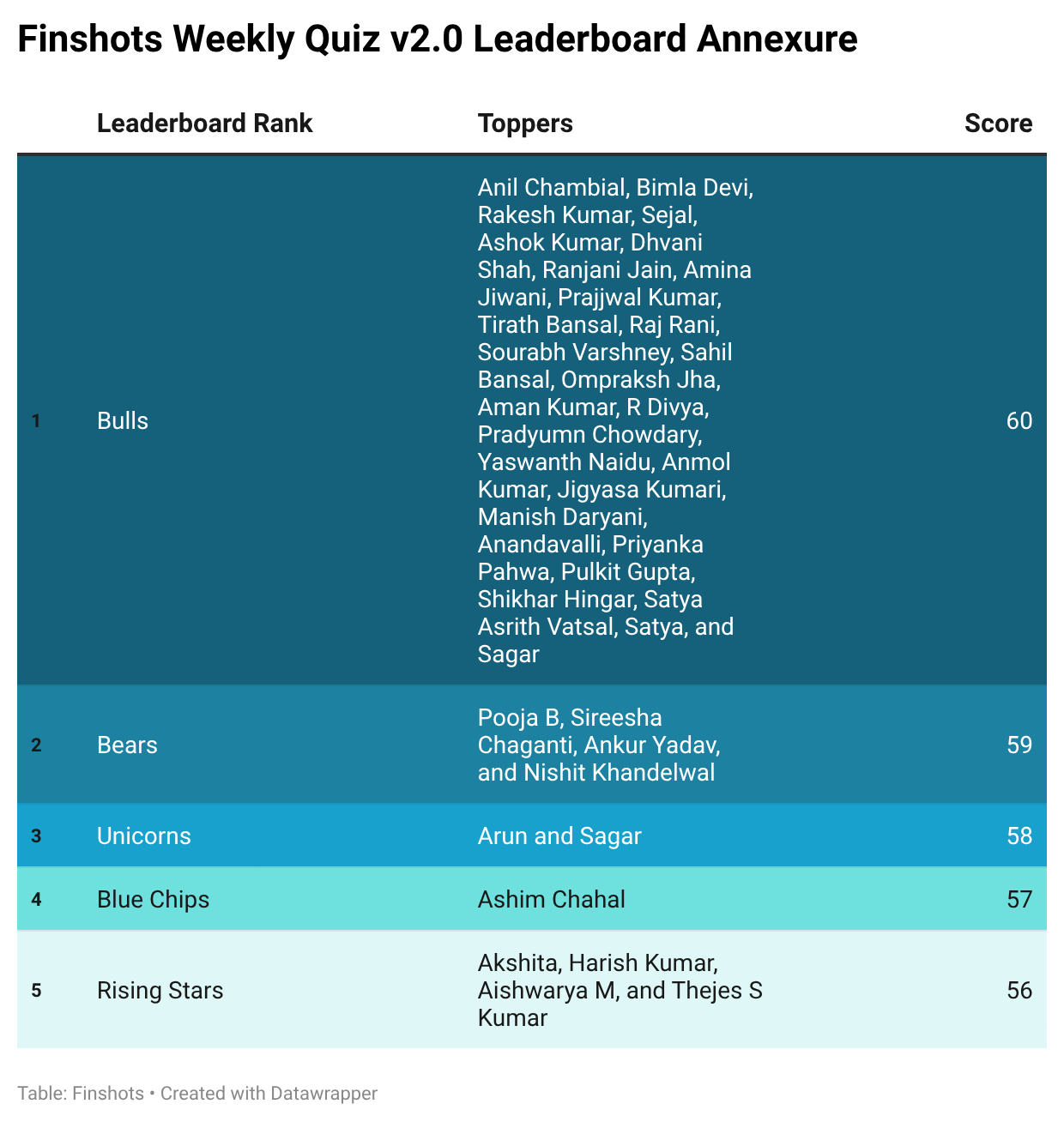

Let’s then move on to the top scorers from our previous weekly quiz. There were quite a few of you who participated, and many of you ended up with the same scores. So we call you Bulls, Bears, Unicorns, Blue Chips and Rising Stars. Here’s how the standings currently look:

If your name appears on the leaderboard, then congratulations! If not, don’t lose hope. If you tried last week’s quiz, keep at it and answer all the weekly quizzes this month. You never know when the turntables! Click on this link to take this week’s quiz, which is open until 12pm, Friday, February 20, 2026. The more answers you get right, the better your chances of appearing on the Finshots Weekly Quiz leaderboard. We will publish it every Saturday in the Weekly Summary. And the winner will be announced in the first week of March.

Did you like this week’s wrap up?

Don’t forget to share it with your friends, family or even strangers WhatsApp, LinkedInand x. And subscribe to Finshotsif you haven’t already. Please!

One last thing.

If you are an NRI, you might be paying much more than you need to for life insurance.

Indian term insurance is often dramatically cheaper. But there’s a catch: underwriting rules change by country, medical tests can get complicated, and not all riders are available everywhere.

That’s why our team reviewed IRDAI guidelines, insurer brochures and real-world application experiences to outline exactly how Term Insurance works for NRIs in India.

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/SBIs-best-quarter-an-AI-energy-crisis-and-more….jpg)

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/A-vegan-cricket-ball-that-lasts-50-overs.jpg)

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/The-Canada-India-uranium-deal-explained.jpg)