In today’s Finshots, we break down SBI’s latest quarterly results.

The Story

State Bank of India (SBI) has just reported what many are calling its best quarter ever. And to be fair, the numbers lend some weight to that claim.

The bank’s overall business, i.e. its total deposits plus advances, grew 11% quarter-on-quarter (QoQ) ₹103 lakh crore. A large part of this came from advances, which in turn pushed up its net interest income, which rose 5% QoQ to ₹45,000 crore.

Higher revenues meant stronger profits. So naturally, net profit grew 4% over the previous quarter and a sharp 24% year-on-year (YoY), posting its highest ever quarterly profit of ₹21,000 crore in Q3FY26. And if you zoom out a bit, for the nine months ended FY26, SBI reported a net profit of ₹60,300 crore, compared to ₹52,200 crore in the same period last year.

And then there is asset quality – something banks are constantly judged on. SBI’s numbers here look particularly solid. Its gross NPA ratio (non-performing assets or total value of loans and advances that have stopped generating income due to defaults) improved to 1.57% (from 1.73% last quarter), while the net NPA ratio fell to 0.39% (from 0.42% last quarter). In fact, these are the lowest levels the bank has seen in more than two decades.

Of course, the market liked what it saw. The stock rose 12% in the week following the results. And as a result, SBI also crossed the market capitalization of ₹11 lakh crore and became the fourth largest listed company in India.

But here’s the thing. Big headline numbers can tell one story. But the deeper details sometimes tell another.

So the real question is – was this really SBI’s best quarter?

On the surface, yes. But scratch that surface just a little, and some interesting nuances start to emerge.

Let’s start with what actually drove those gains.

Interest income has undoubtedly risen. But a significant part of the boost came from non-interest income, not all of which was normal. To put things in perspective, SBI has a one-time special dividend of ₹2,200 crore of its subsidiary, SBI Mutual Fund. This has also been discussed ₹770 crore as interest on income tax refunds. Add to that a huge 174% year-on-year jump in treasury operations – mainly profit from the revaluation of its own investments.

Now treasury profits are still part of the bank’s earnings. But they are not the core, steady, bread-and-butter banking income.

And when you adjust for this one-time adjustability, the net interest margin (NIM), or the difference between the interest the bank earns on loans and what it pays on deposits and loans, relative to what its assets earn, starts to look a little different.

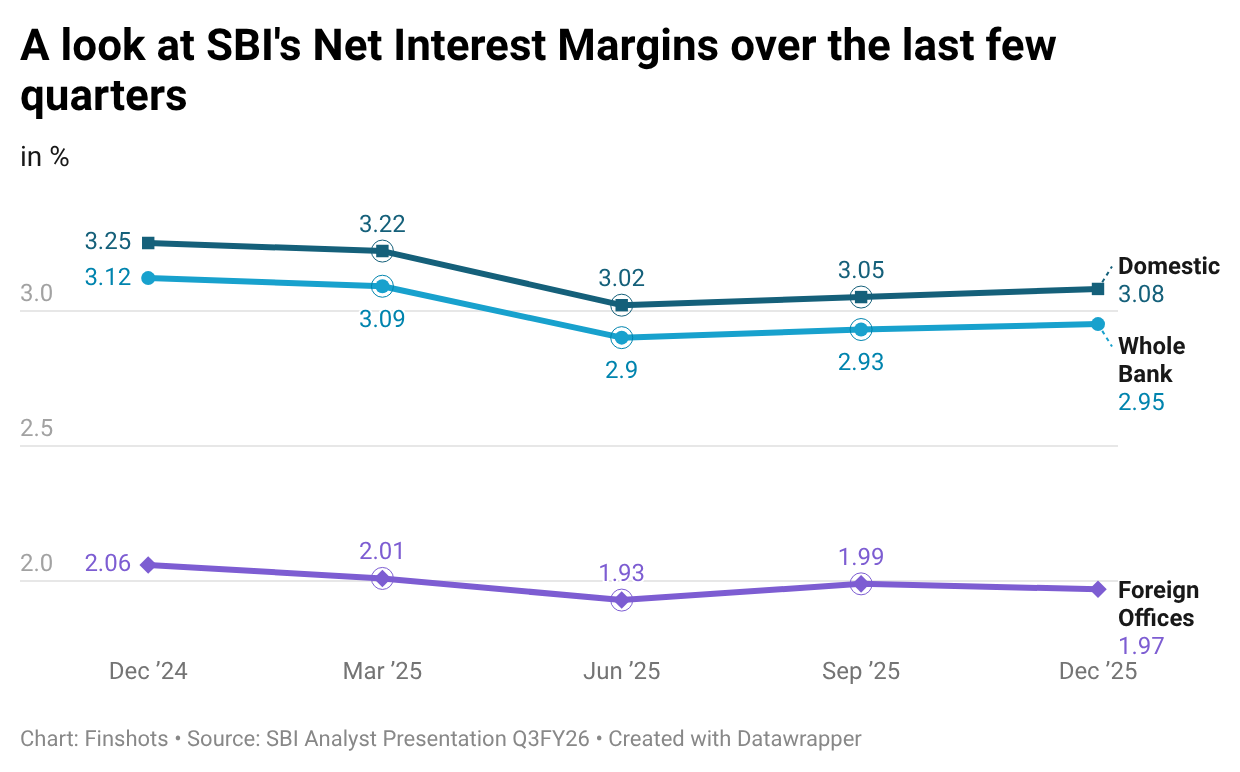

What this means is that NIM rose by 2 basis points to 2.95% on a QoQ basis. That sounds good. But if you look at the chart since Q3FY25, you will see that SBI’s NIM has failed by 17 basis points. And if you adjust for that one-time income we talked about earlier, NIM actually looks 1 basis point weaker than reported this quarter.

Now, 1 basis point may not sound dramatic. But when you notice a gradual downward trend over several quarters, it starts to matter.

And this is important because we are in an environment where deposits are not easy to collect. Banks compete hard for them. When funding costs rise and deposit growth becomes more difficult, maintaining margins becomes a delicate balancing act.

This brings us to the one metric that everyone keeps circling to when talking about NIM – the CASA ratio. CASA stands for Current Account Savings Account deposits. And CASA ratio is CASA deposits expressed as a percentage of a bank’s total deposits.

And this relationship slowly became the biggest headache for banks lately since it slipped through the industry. In particular, many private banks have not been able to grow their CASA books meaningfully. This is, of course, because depositors prefer to park their money in the stock market or other higher-yielding instruments, instead of just leaving them almost idle in their bank accounts.

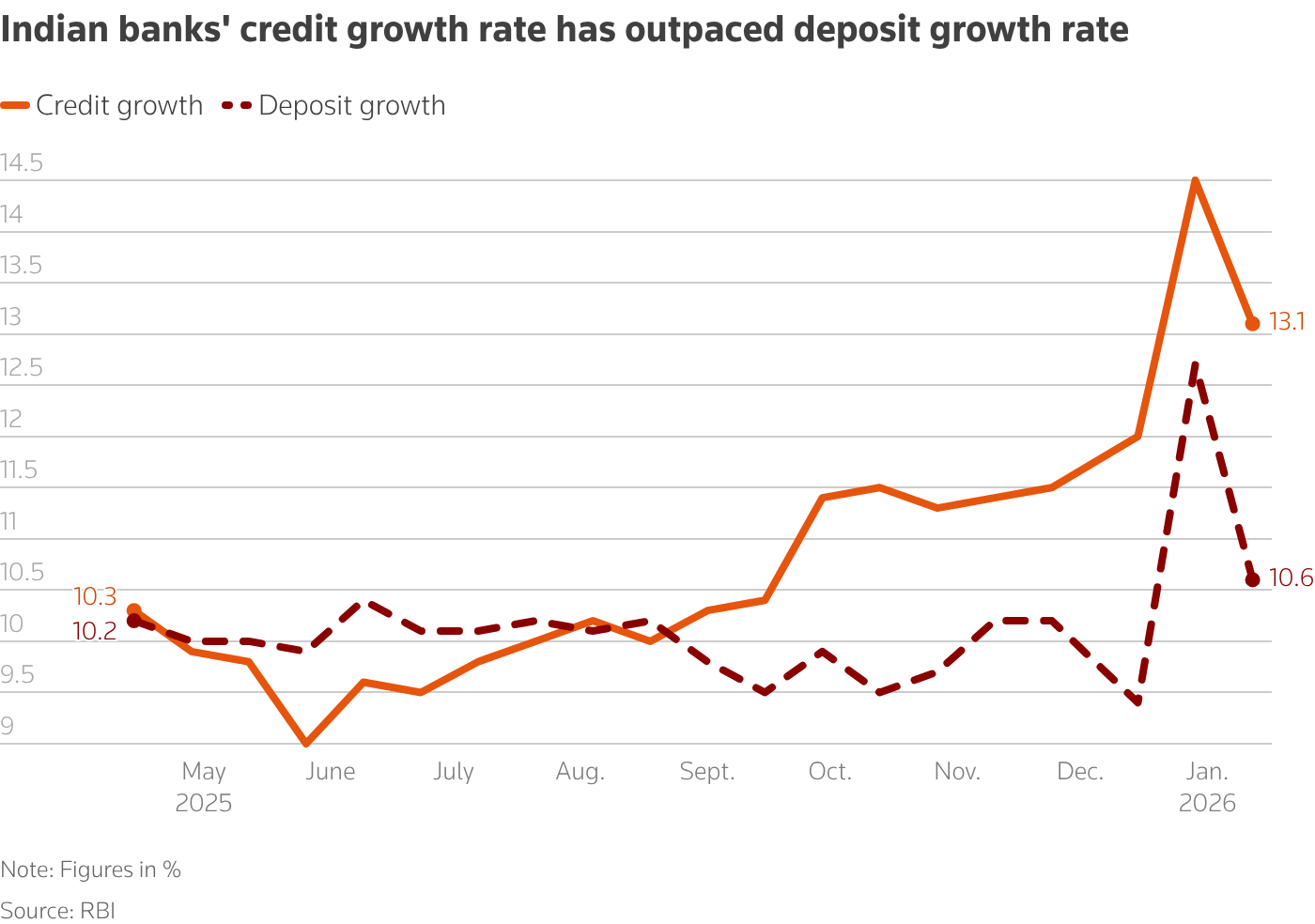

But the thing is that these CASA deposits are the cheapest source of funds for banks. Savings accounts usually cost them around 2.5–3% in interest, while current accounts cost nothing. And the loss of these cheap CASA deposits creates a problem especially since credit growth across India outpaced overall deposit growth.

So when credit demand rises and CASA deposits do not grow fast enough, banks are forced to read more about term deposits, which come with higher interest rates. This increases their cost of funds. And when that happens, their NIM starts shrinking.

We have seen this play out in many large private banks.

For example, HDFC Bank’s CASA ratio has declined 34% to 33.6% on an annual basiseven though total deposits grew by 11%. Kotak Mahindra Bank saw a sharper decline. Its low-cost CASA ratio fell 101 basis points year-on-year to 41%, despite deposit mobilization rising 14% and credit disbursements rising 16%. Axis Bank was not spared either. Its CASA ratio fell 60 basis points to 39%, even as loans grew 14% and deposits increased 15%.

This makes SBI’s CASA performance look comparatively stronger. For context, its CASA ratio stood at 39.13% in Q3FY26, only marginally lower than 39.2% a year ago. More importantly, its CASA deposits actually grew by 8.88% YoY, touching ₹21.4 lakh crore.

The only other major bank that managed to keep its CASA ratio broadly stable was ICICI Bank at 39%. But if you look at the scale, there is a big difference. While ICICI’s CASA deposits stand at around ₹6.5 lakh crore, SBI’s are more than five times that.

Which makes you wonder – how exactly does SBI manage to hold on to its CASA in such a tight liquidity environment?

At first glance, the answer seems obvious. SBI is the default banker for central and state governments, PSUs and millions of salary and pension accounts. This naturally gives it a steady stream of low-cost deposits. And yes, that is a real benefit.

But even the mobilization of the current state account has dried up of late.

That is why SBI has been spinning quietly for the past few years. It read more in private sector business accounts. This shift led to a steady rise in current account balances. Instead of aggressively pursuing affluent retail customers like some of its peers, SBI has focused on granular SMEs and MSME accounts. It has also partnered with institutions such as temples, universities and similar organizations to build “sticky” current accounts, which equate to low-cost deposits that don’t flee at the first sign of a higher interest rate elsewhere.

And then of course there is scale.

SBI is simply massive. It accounts for about a quarter of all loans in India. For every ₹100 borrowed in the country, about ₹22–23 comes from SBI. This is serious charge.

Add to that his physical presence – more than 23,000 branchesmore than the next five banks combined. That reach enables SBI to mobilize even the smallest household deposits from the smallest villages. Individually, those amounts may seem small. But together they meaningfully strengthen the CASA book. And this, in turn, helps to keep its credit-deposit ratio in a relatively comfortable position, even as the demand for credit continues to arise.

So yes, that’s pretty much the story behind SBI’s so-called best quarter.

And maybe it’s fair to call it that. Because even though SBI clearly has structural advantages on its side, it has still managed to hold steady in the face of some real headwinds.

The numbers look strong. The foundation looks stable. And while not every measure is improving significantly, the bank is still holding its own at a time when many others are facing pressure.

And sometimes that’s good enough to earn the title.

Until next time…

Did you like this story?

Share it with a friend, family member or even strangers WhatsApp, LinkedInor x.

Before you go…

A quick note for our NRI readers!

If you live abroad, there’s a good chance you’re paying too much for life insurance.

Indian term insurance can often be much cheaper than policies in the US, UK or Singapore. But eligibility rules, medical tests abroad, rider restrictions and claim settlement in INR can quickly get complicated.

So we’ve put together a practical, no-fuss guide about Term Insurance for NRIs in India covering premiums, documentation, underwriting, and what actually happens during a claim.

If you are earning abroad but your family is dependent on India, it is worth 5 minutes.

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/SBIs-best-quarter-ever.jpg)

![[keyword]](https://learnxyz.in/wp-content/uploads/2026/02/The-Fractal-Analytics-IPO.jpg)